The $16 salad is dead. And it’s taking the entire fast-casual empire down with it.

Sweetgreen’s stock has cratered an astounding 80% this year—yes, you read that right. Same-store sales plunged 9.5% with traffic down 11.7%. Their CFO just retired. Two-thirds of their restaurants have operational issues. And they’re selling off their much-hyped robot automation division for a fraction of what they invested.

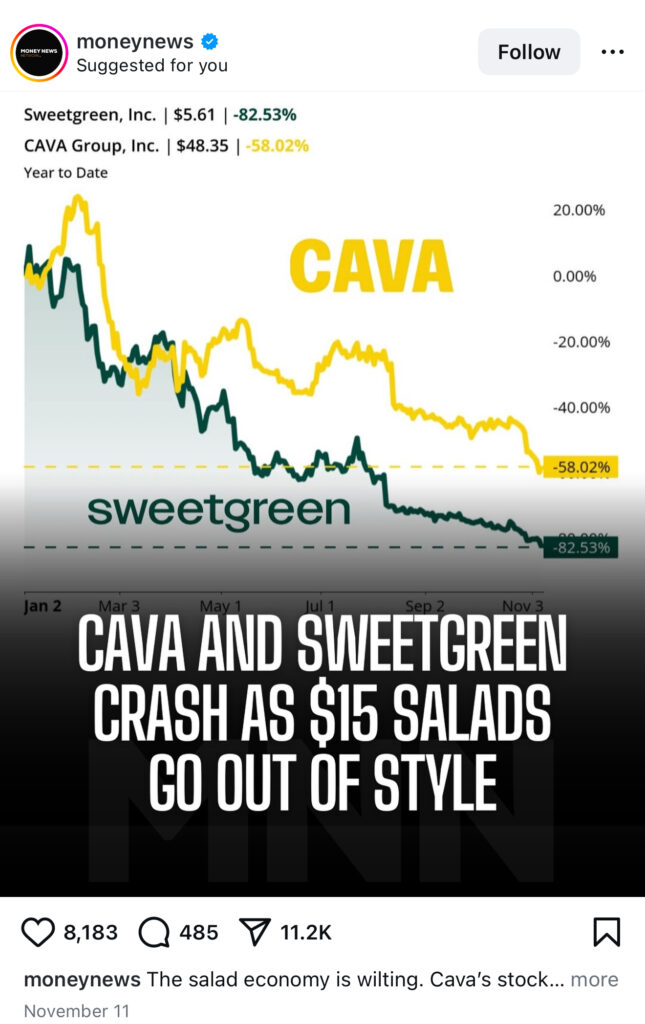

Meanwhile, CAVA isn’t faring much better, down 54% year-to-date after cutting guidance twice.

But here’s what the financial press won’t tell you: This isn’t a correction. It’s an extinction event for overpriced salad economics.

The $16 Salad That Broke the Camel’s Back

Sweetgreen became the poster child for everything wrong with fast-casual economics. Their average salad costs $16—for lettuce, folks. That’s before tax, tip, and the emotional damage of spending twenty bucks on lunch.

The numbers tell the whole story:

- Same-store sales declined 9.5% with an 11.7% drop in foot traffic

- Two-thirds of restaurants had operational issues last quarter

- The company still hasn’t figured out how to turn a profit after 18 years in business

- They’re selling their vaunted “Infinite Kitchen” robot automation for $186 million—a desperate cash grab after the tech failed to fix their economics

When your solution to unprofitability is to charge more for salads while your robot kitchens still can’t make you money, you don’t have a business model. You have a VC-subsidized delusion.

CAVA’s facing the same reality check. Traffic was flat compared with the year-ago period, desperately hiking prices just to maintain revenue. Their CFO admitted the 25- to 34-year-old consumer seems to be impacted a bit more than others—translation: the people who actually eat lunch at work can’t afford this anymore.

Lines, Labor, and the Lunch Hour Crisis

Here’s what CAVA and its peers don’t want to discuss: their business model is fundamentally broken for today’s workplace.

Fast-casual chains require:

- Expensive real estate near office buildings

- 15-20 employees per location

- Customers willing to spend 30+ minutes of their lunch hour standing in line

- Daily commuters who actually leave their buildings

Sound familiar? It’s the same outdated thinking that killed corporate cafeterias—just with better branding.

The Smart Cooker™ Revolution: Restaurant Quality Without the Restaurant Problems

While CAVA struggles with same-store sales growth of just 1.9%, we’re installing Smart Cooker™ systems that deliver chef-prepared hot meals in under 7 minutes—right in the break room. No lines. No tips. No weather walks. No staffing headaches.

Our partnership with Southerleigh Hospitality Group means employees get restaurant-quality meals at prices that actually make sense. We’re talking $10-12 for a hot, chef-prepared entrée—not a $16 salad that leaves you hungry by 3 PM.

Why Property Managers Are Ditching Food Trucks for Smart Tech

Commercial real estate leaders are watching this massacre and connecting the dots. Sweetgreen’s stock holds a “Strong Sell” rating with analysts predicting further 23% declines. CAVA’s experiencing similar death spirals with multiple guidance cuts. Even Chipotle reported a 4% same-store sales decline.

The verdict is unanimous: The era of hoping tenants will trek to overcrowded, overpriced fast-casual chains is over.

Here’s what killed the golden goose:

- Sweetgreen’s “Fries You Can Feel Good About” lasted five months before disappearing—even their attempts at menu innovation failed

- CAVA’s same-store sales growth of 1.9% can’t justify their real estate footprint

- Both chains require massive capital for each location while delivering negative or minimal profits

- The core demographic (25-34 year olds) faces higher unemployment and resumed student loan payments

Smart building owners are installing our Smart Fridge™ + Smart Cooker™ systems because they:

- Operate 24/7 without staff

- Serve hot meals in minutes, not millennia

- Actually get used by employees who value their time

- Don’t require $2M build-outs or endless permitting

The Numbers Don’t Lie (But Wall Street Wishes They Did)

- Sweetgreen: Down 80%+ YTD, trading at distressed P/S ratio under 1x, never been profitable

- CAVA: Down 54% YTD, cut guidance twice, expects continued margin compression

- Combined market cap destruction: Over $8 billion in shareholder value vaporized

Meanwhile, we’re expanding across Texas with a 120-day free trial that lets properties test the future of workplace dining risk-free. While these public companies burn through cash trying to fix their “operational issues,” we’re delivering hot, chef-prepared meals for $10-12—less than the price of a Sweetgreen salad, and won’t leave you hungry.

The Automation Fantasy That Fooled Everyone (Except Us)

Here’s the kicker: Sweetgreen bet the farm on their “Infinite Kitchen” robots to save their margins. The result? After two years and hundreds of millions invested, they’re selling the entire division to Wonder for $186 million just to stay afloat. The robots couldn’t fix a broken business model.

Meanwhile, our Smart Cooker™ technology actually works—because we didn’t try to automate salad assembly. We partnered with Southerleigh Hospitality Group to deliver chef-prepared meals that heat perfectly in our proprietary induction pods. No robots trying to toss lettuce. No “operational issues” at 40% of locations. Just proven technology that works 24/7.

The Bottom Line: Evolution or Extinction

The simultaneous collapse of Sweetgreen and CAVA isn’t a coincidence—it’s structural. When your business model requires customers to:

- Leave their workplace in any weather

- Stand in line behind 15 other people

- Pay $16-20 for a single meal

- Tip on top of already inflated costs

- Pretend that lettuce is lunch

…you’re not solving workplace dining. You’re the problem that needs solving.

The Smart Cooker™ revolution isn’t coming. It’s here. And while Wall Street watches billions in market cap evaporate from overpriced salad stocks, we’re too busy installing the actual solution in buildings across Texas.

Ready to give your tenants what they actually want? Skip the failing fast-casual model and bring Smart Cooker™ technology to your building. No lines. No staffing. No $16 salads. Just restaurant-quality hot meals, ready in minutes.

Because the future of workplace dining isn’t about better salads. It’s about smarter food.

About Raptor Vending

Raptor Vending is Texas’s first and only Smart Fridge™ + Smart Cooker™ experience provider, revolutionizing workplace dining through our exclusive partnership with Southerleigh Hospitality Group. We’re not a vending company—we’re a smart food experience company that’s redefining how commercial real estate delivers food amenities.

Contact: 385-438-6325 | ryan@raptor-vending.com